The conversation has changed

It’s no longer ‘if’ we deal with climate change, it’s ‘How’ we deal with it.

Businesses are making ambitious climate commitments to keep global warming below 2°C—and ideally 1.5°C—in line with the Paris Agreement so how can they leverage all the solutions available to accelerate the transition to a net zero economy?

Carbon finance offers a roadmap for companies to not only take immediate action but also pave the way for the innovative solutions that we need to scale up and deliver greater impact.

Over the course of this decade, our response to climate change will shape the world for generations to come. These years will have an outsized effect on the environment, biodiversity, health, and livelihoods.

Between now and 2030, an ambitious global effort is underway to deliver on the promise of the United Nations (UN) Sustainable Development Goals (SDGs)—including SDG 13, which calls for “urgent action to combat climate change and its impacts.” But for many companies, the path from ambition to execution remains unclear.

Sustainability has become a measure of business competitiveness and health, and any corporate strategy should evaluate all the available options to make the most informed and strategic decisions. Extreme weather events are interrupting supply chains and causing economic damage, climate change impacts human health and livelihoods—particularly for the most at-risk populations - and companies with a greater purpose have a better chance of attracting and retaining the best talent.

I’m working with many companies who want to build an approach that not only delivers results now, but also supports the solutions that will ensure the long-term health and resilience of our planet and communities around the world. And in this white paper on carbon innovation we outline the ways companies can blend solutions by funding proven projects alongside financing new projects and technologies that are becoming available. Carbon finance plays a unique role in accelerating these innovations by pairing project types with credible third-party certified methodologies as they mature.

Carbon finance as a function of corporate climate strategy

Through their global reach across borders and access to the capital to drive lasting change, companies have a natural fit with carbon finance, which directs funding where it’s needed most: to sustainable development projects making a difference on the ground. Natural climate solutions, clean energy and infrastructure, and improved household devices, such as clean cookstoves, are all benefitting from carbon finance. And the voluntary carbon market enables companies to offset unavoidable emissions, fast-tracking efforts to reduce emissions globally and support the much-needed transformation of our economy - everywhere.

So, what’s the best way for companies to capitalize on these opportunities? There’s no one size fits all answer, and each company must evaluate the approach based on their strategies and priorities: costs, locations, timelines, availability, risk profile are all considered.

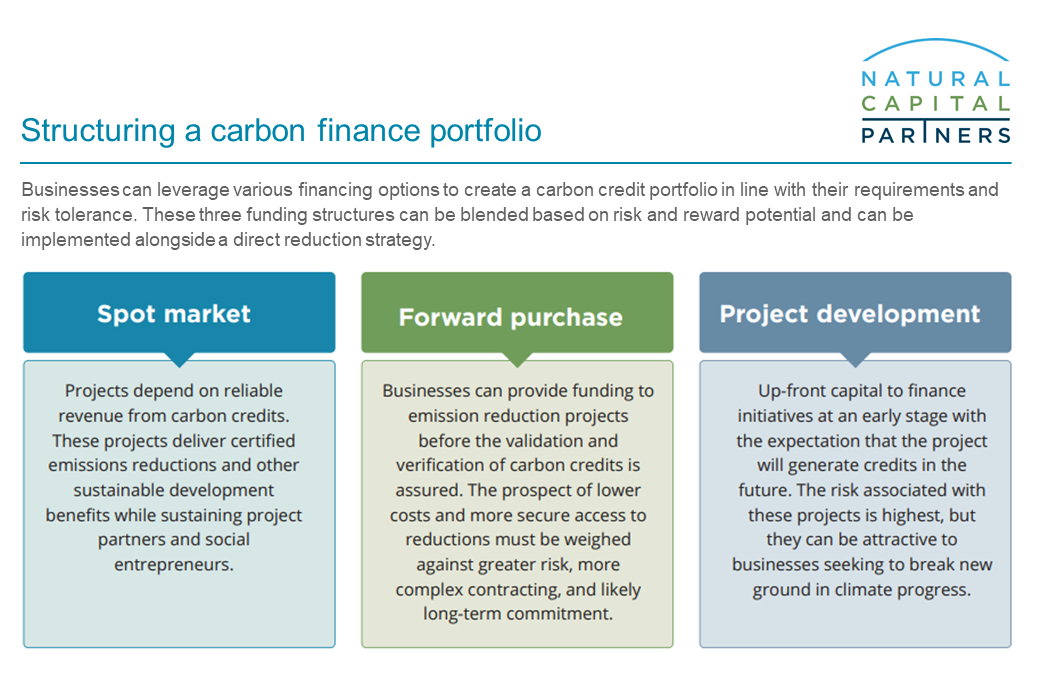

Carbon finance can take different forms and companies can benefit from a portfolio approach. The chart below provides an overview of the three most common approaches that can be blended together: spot market purchases, forward purchases, and project development.

A practical and flexible approach to achieving carbon neutrality and net zero goals

A portfolio approach does not limit a company to one approach or another. In fact, the flexibility of a portfolio approach is one of the greatest benefits and it makes carbon finance more accessible to businesses at any stage in their sustainability journey. Many of our clients are funding multiple projects at different stages to meet their goals. For example, a company may purchase from the spot market to meet a carbon neutrality commitment today while also financing new project development with the expectation that the project will generate credits to meet a net zero goal by 2030.

Solutions for the future

Innovation in new technologies is critical to achieving our climate ambitions—and there are several emerging technologies that could unlock new opportunities to reduce and remove carbon emissions. Carbon capture and storage is gaining a lot of attention, but it will take time for these projects to make an impact at scale. To be more accessible and achieve valuable carbon finance revenue, they must pass certain tests to be approved by a reputable independent standard.

And in the meantime, we can’t overlook the importance of existing projects that have resulted from carbon innovation over the last 20 years. It will take many different approaches and ideas to achieve ambitious targets while creating a steady pipeline of high impact, high-quality solutions. This not only supports the activities already taking place to reduce and remove emissions—consider the rainforests, temperate forests, mangroves, grasslands, and communities that are delivering results today—it also allows more companies to get involved. And that is critical to ‘How’ we solve this challenge.

Download our white paper to learn more

Carbon Innovation for Business Impact

PDF, 7,5MB

TéléchargerDernières actualités

New test article 2023

A dummy article to test title issue.

Pour en savoir plus

FR Test News Article

Article test en français

Pour en savoir plus

Natural Capital Partners and ClimateCare become Climate Impact Partners

Natural Capital Partners and ClimateCare become Climate Impact Partners and sets goal of delivering 1 billion tonnes of emission reductions by 2030.

Pour en savoir plusLes toutes dernières Insights de

Climate Impact Partners

10 idées reçues à abandonner sur la compensation carbone

10 idées reçues à abandonner sur le net zéro et la compensation carbone.

Pour en savoir plus

FR Test insight article

Testing all plug-ins in 2 column format for French

Pour en savoir plus

FR - Innovation test insight article

As carbon markets grow and innovate how can Web 3.0 be harnessed in a positive way to build scale and impact?

Pour en savoir plus