Everyone is talking about fast growth in the carbon markets, but what does this mean for the projects around the world that are delivering the emission reductions we so desperately need? Rob Stevens, Director of Policy & External Affairs explains.

Corporate Demand is Growing

Corporate demand for carbon credits has increased significantly in the past two years and growth is set to continue.

There is no doubt that the number of organizations compensating for their carbon emissions is increasing and increasing fast.

The annual value of the voluntary carbon market (VCM) is on track to exceed $1 billion in 2021 for the first time, with around a 70% increase in credit issuance compared to 20201.

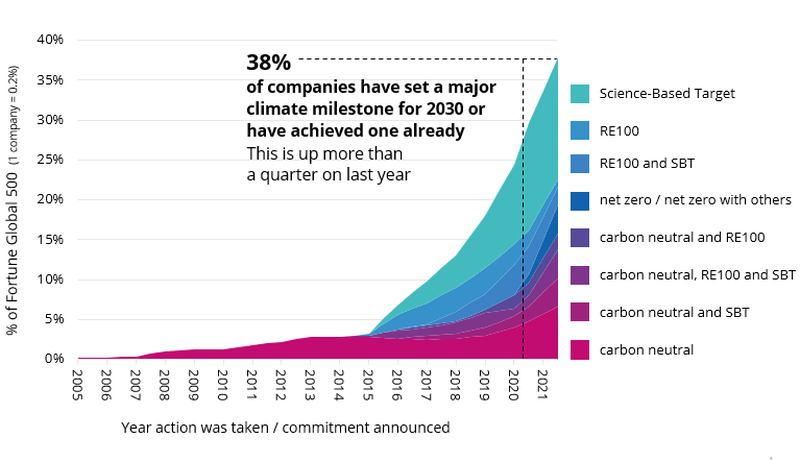

And our recent Fortune Global 500 research, which tracks the climate commitments made by the world’s biggest companies, shows similar growth: carbon neutrality and net zero commitments are up by more than a quarter and 38% of the companies have now set a major climate milestone for 2030, or have achieved one already.

But while an increase in corporates taking responsibility for climate action over the past two years is driving substantial demand, there is still room for growth.

Over 60% of the Fortune Global 500 companies still haven’t made commitments2. And they face increasing pressure from their stakeholders to act. Customers, investors, and staff all want to see business doing more.

The Taskforce for Scaling the Voluntary Carbon Market, which was established by the private sector to help the market meet the goals of the Paris Agreement, states that the voluntary carbon market must scale at least 15-fold by 2030 in order to play its part in the delivery of global climate targets.

The increase in demand from companies is leading to increased interest in scaling up existing emission reduction projects as well as attracting finance to develop new ones.

But in order to deliver long-term success, projects need an informed approach to accessing the finance.

If you want to start or scale an emissions reduction project, how can you best capitalise on this potential new source of carbon finance to ensure you maximise project income and secure the sustainability of your project?

Complexity is Increasing

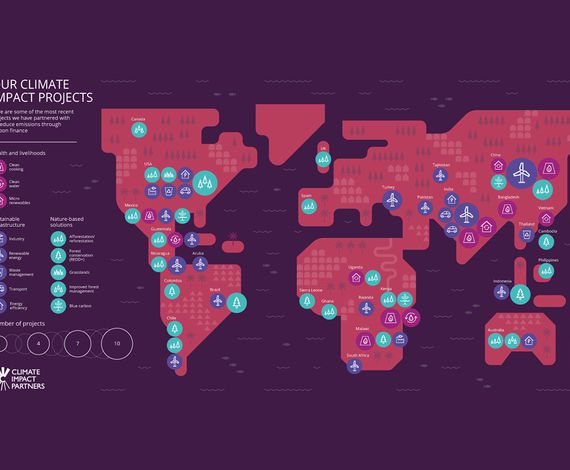

Working with over 500 corporate clients across six continents, we see first-hand the trends in the marketplace as they unfold. Companies are at vastly different stages in their climate journey, with a wide range of pledges and varying objectives in the decision to finance external emission reduction projects.

Best practice and corporate climate leadership is changing

As a result, corporates are seeking advice to make robust pledges and delivery plans, working with trusted partners who can help them deliver a strategy over the long term.

The majority look for a portfolio of projects that can generate high integrity emissions reductions and to ensure the climate claims they make are credible, accurate and in line with best practice – and to supply them with the materials that will support their action.

Managing their reputation while on the journey to decarbonise is becoming increasingly important as the media spotlight shines more brightly on anything that could be misleading.

We’ve worked with many clients for more than 10 years and are supporting them as they raise their ambition over the next decade. They rely on us to provide them with independent assurance about a project’s quality, integrity, and impact. And we conduct robust due diligence on their behalf, giving them the confidence to invest.

Portfolio approach

Each company has its own priorities for the types of projects and the locations in which they want to take action, with many supporting a portfolio of projects in technologies and locations which fit their specific requirements. A portfolio approach enables corporates to manage risk, deliver to budget and support different regions relevant to their business.

This makes it more difficult for an individual project developer to access this demand, making it more attractive to work with a partner who has already nurtured and understood these client relationships and which has established the systems and processes to meet and respond to client expectations.

Positive impact for people and biodiversity is key

Alongside verified emissions reductions, additional project impacts, generally those aligned with the UN Sustainable Development Goals (SDGs), continue to be strong motivating factors for corporates.

A focus on the positive social, biodiversity and equality impacts provided by our project partners is vital in attracting companies to purchase carbon credits or invest in project development.

That is why we choose to work with on-the-ground project implementation partners who understand the local stakeholders and ecosystems and have the highest standards of conduct. We also help quantify these multiple outcomes for corporates by taking projects through certifications like the Climate, Community and Biodiversity Standard (CCB), SD VISta and Gold Standard for the Global Goals.

Custom project development

Increase in demand has driven the price of carbon credits up to a level that makes new project development financially viable and we are seeing greater interest from our clients in financing new projects.

This represents a different level of engagement with projects over a much longer period, and with a different risk profile. Clients are highly selective in the partners with whom they work – and our project partners are equally selective in choosing funding partners who understand the real complexity of project development.

In the past 12 months alone, we have secured over $50m of funding to finance the early-stage development of new reforestation, forest restoration, and energy efficiency projects. And we are on track with our plan for that fund to grow significantly to protect and restore nature and improve livelihoods over the next five years.

Demand is for a mix of nature-based solutions, carbon reduction and carbon removal projects

With world leaders at COP26 pledging to end and reverse deforestation by 2030 and increasing numbers of organisations pledging to reach net zero, nature-based projects (which both protect remaining forests and create new natural carbon sinks) will continue to be in high demand.

However, our clients understand that all project types remain an important part of the set of solutions needed, to reach our climate goals. We work with them to build a mixed programme of project activity that supports projects that remove emissions from the atmosphere and those that avoid further emissions.

This maintains flows of funding to develop and scale avoidance projects - from rainforest protection to clean cooking and safe water solutions – in addition to nature-based solutions.

Opportunities for project developers

Finance is available for high quality projects.

To access the finance available, you need to work with a partner who has a good understanding of and access to corporate demand.

Project owners are rightly focused on the business of delivering their project outcomes. Some need support to steer through the technical carbon asset development process to produce the type of high integrity carbon credits demanded by companies.

Other more established project developers may be interested in using carbon finance to scale their business further, for example to new regions or countries. We recommend working with an expert partner who has a proven track record of helping projects issue high quality credits and sell them over the lifetime of a project, and who will support you as the market fluctuates.

Methodologies already exist

There are existing methodologies to generate carbon credits for many project types including agroforestry, afforestation, reforestation, cookstoves, clean water access, bio energy, and sustainable land management. Other new methodologies, for example to cover some types of blue carbon projects, are in development.

If an appropriate project methodology doesn’t already exist, and you have a project activity which is demonstrably reducing emissions, there is the option to develop a new methodology and register it with the standards.

Climate Impact Partners has a long history of methodology development. We lead authored the first Gold Standard cookstove methodology in 2007, which allowed carbon finance for clean cooking projects and which is now used by more than 700 projects around the world. And we continue to innovate.

The recently approved Gold Standard methodology to measure carbon emission reductions from the use of electric and other metered cooking devices developed by Climate Impact Partners and the Modern Energy Cooking Services programme, will make a significant difference to the resources required for verifications.

With increasing demand, we’re going to see many more innovations such as the 14Trees project in Malawi where Climate Impact Partners worked closely with project partners to design a carbon project methodology that accurately calculates the carbon reductions achieved by using Durabric® rather than conventional kiln-fired brick alternatives.

In our experience the international approval process can often take up to two or three years, but it can open up access to carbon finance for new project categories. This is a complex but rewarding process and working with a partner who has experience and expertise in writing carbon methodologies and taking them through to approval is essential.

Post-COP26 Outcomes

New opportunities and new considerations for project development

One of the key outcomes of COP26 was that countries finally reached agreement on Article 6 of the Paris Agreement.

After six years of difficult negotiations, agreement on Article 6 cements the important role of carbon markets in the global response to tackling climate change.

It’s important to note that Article 6 applies specifically to nation to nation and other compliance carbon markets such as CORSIA and does not explicitly set any rules for the voluntary carbon market (VCM). However, it does provide guidance for the VCM, although there will be a period of uncertainty as new, Paris-era best practice is determined.

COP26 has strengthened our view that the VCM will move towards multiple tracks – opening up new opportunities.

- Under Article 6 some carbon credits will be authorised for transfer of Emission Reduction units (ITMOs) between Parties through Corresponding Adjustments (CA) and some will not. Both will have a market but the authorization status will affect appropriate use of the credits.

- Countries will decide whether and how to encourage private sector investment within their national mitigation activities.

- Corporates will continue to support projects that resonate with their business and support their immediate, mid-term and long-term commitments - but how they communicate their actions will change.

Access our on-demand webinar where our experts share their insights from COP26 in detail and discuss the impacts for project developers.

To Sum It Up…

There is great opportunity for project developers to benefit from increasing corporate demand for both removal and avoidance projects to tackle climate change. However, accessing this demand and upfront development funding is not straightforward. Project developers looking to scale their impact will benefit from working with an experienced partner who has access to finance, is trusted by large, creditworthy buyers of credits, understands the complexity of carbon finance project development, and who is abreast of changes in the wider market that will influence their projects. Do that, and projects will be able to access and make best use of the opportunities which this unprecedented growth offers, and that means that together we can make real change possible.

$1 billion The amount of annual value the voluntary carbon market (VCM) is on track to exceed in 2021

18.5 million Tonnes of CO2 reduced by the clean cooking methodology we lead authored